FAQS:

| What is TAX? | According to the National Tax Policy of Nigeria, tax is any compulsory payment to the government imposed by law without direct benefit or return of value or a service whether it is called a tax or not. | ||||||||||||

| What is Joint Tax Board (JTB)? | JTB is the apex body for Tax Administration in Nigeria responsible for promoting and ensuring uniformity, harmony and efficiency in Personal Income Tax Administration and provide advice on general tax matters in Nigeria as enshrined under the provisions of the Personal Income Tax Act, CAP, P8 LFN 2004 as amended | ||||||||||||

| What is Road Tax? | Road tax is one of the various tax types that is administered by the State Governments through the State Internal Revenue Service or any other designated agency within the State. | ||||||||||||

| What is the SIRTS

& SHF initiative?

|

The SIRTS is “a Single Inter-State Road Taxes Sticker for any vehicle within Nigeria designed by the Joint Tax Board for all the States and the Sticker is to be administered by all the States”

It is provided for in Part IV (2)(a) of the Schedule to the Taxes and Levies (Approved List for Collection) Act (Amendment) Order 2015. The SHF is “a Single Haulage Fee payable at the points of loading in the States of departure and Single Haulage Fee payable at the points of discharge of goods which the States are required to set up institutional structure to collect”. It is provided for in Part IV (2)(b) of the Schedule to the Taxes and Levies (Approved List for Collection) Act (Amendment) Order 2015. |

||||||||||||

| Is the SIRTS and SHF a new or additional tax? | The SIRTS and SHF is not a new tax. It has been provided for since the amendment Order of 2015.

The JTB through the approval of the States is just introducing a more effective and efficient platform for the seamless administration of the SIRTS and SHF. |

||||||||||||

| Who collects and administers SIRTS? | The Single Inter-State Road Taxes Sticker is to be collected and administered by the State Government through its State Internal Revenue Service.

The SIRTS revenue goes directly to the State where the vehicle was registered or where the vehicle papers was renewed. |

||||||||||||

| Who collects and administers SHF? | The Single Haulage Fee is to be collected and administered by the State Government through its State Internal Revenue Service.

The SHF revenue is shared between the State where the loading took place (State of departure/loading State) and the State where the goods are offloaded (State of final destination) |

||||||||||||

| What is the role of the Joint Tax Board in the administration of SIRTS and SHF? | For the SIRTS, as contained in the Part IV (2)(a) of the Schedule to the Taxes and Levies (Approved List for Collection) Act (Amendment) Order 2015, the Joint Tax Board will design the Sticker (electronic Sticker) and ensure that it contains verification features that will allow States easily administer it within their jurisdiction and acceptable across the federation.

For the SHF, as contained in the Part IV (2)(b) of the Schedule to the Taxes and Levies (Approved List for Collection) Act (Amendment) Order 2015, the Joint Tax Board is providing a uniform platform that will serve as the institutional structure for the implementation of the initiative. This is necessary to ensure uniformity and harmony in administration of the fees. This may not be achieved if States decide to implement individually. Please note that JTB is not collecting any of this revenue. The JTB is only providing a uniform platform for effective and efficient collection of the SIRTS and SHF by the States. |

||||||||||||

| What are the expected outcomes of the SIRTS and SHF initiative?

|

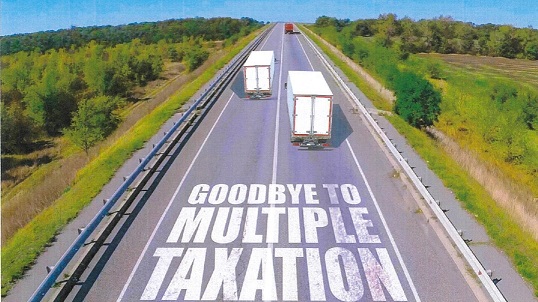

a. Reduction of incidence of double taxation and sanitizing the road tax administration nationwide.

b. Restore the integrity of the road tax collection process and ensuring that all collection of SIRTS and SHF is remitted appropriately to Government coffers and accounted for. c. Eliminate the prevalence of illegal roadblocks in the nation’s transportation corridors. d. Increase Internally Generated Revenue for States. e. Elimination of illegal collectors in the Nigerian tax environment. |

||||||||||||

| Who pays the SIRTS fees? | All motorists are expected to pay for the SIRTS annually at the point of registration and/or renewal of vehicle papers. | ||||||||||||

| Who pays the SHF fees? | The SHF is paid by only haulage operators/companies at the point of loading in the State of departure to cover loading and offloading fees. | ||||||||||||

| How often will the SIRTS be paid? | The SIRTS is paid annually at the point of registration and/or renewal of vehicle papers. | ||||||||||||

| How often will the SHF be paid? | The SHF will be paid per trip i.e., when the haulage operator/company embarks on a trip. | ||||||||||||

| Who administers the SIRTS? | The SIRTS is administered by the respective State Internal Revenue Service. | ||||||||||||

| Who administers the SHF? | The SHF is administered by the respective State Internal Revenue Service. | ||||||||||||

| How will the SHF be paid? | The SHF will be paid at the point of loading through approved POS agent. The system automatically splits the revenue between the State of loading and the offloading State.

This is made possible because at the point of loading, the profiled vendor is required to capture the details of the haulage operator into the system (android POS). Part of the details to be captured include the category of the vehicle and the destination of the vehicle. The system uses the information to determine the amount to be paid and the States to benefit from the revenue. |

||||||||||||

| Who are the Vendors of the SIRTS & SHF initiative? | The vendors are registered companies/enterprises/business entities that will be profiled by the States Internal Revenue Services. They will be at the various loading points in the States for the sales of the virtual sticker. | ||||||||||||

| Who appoints the vendors? | The vendors are appointed by the States Internal Revenue Services. | ||||||||||||

| Who identified the loading points in my State? | The Joint Tax Board secretariat obtained the list of all the loading points in Nigeria from the National Freight Haulers Association (NFHA).

The list was circulated to States for their consideration and review. The loading points will assist States in the deployment of the vendors |

||||||||||||

| What is the rate for the SIRTS? | As approved by the Appraisal and Technical Committee of the JTB, the SIRTS will be sold at the rate of N3,500. | ||||||||||||

| What is the rate for the SHF? | The SHF will be charged based on the type of vehicle. Below are the categories of vehicles and their rates:

|

||||||||||||

| Who are the identified stakeholders of SIRTS & SHF initiative?

|

The following are the identified stakeholders of the initiative:

|

||||||||||||

| How will the motorists and Haulage Operators identify a vendor? | A vendor approved by the State will be given an Identification Card with a customized vest. | ||||||||||||

| Will there be a physical sticker? | No.

To ensure that illegal persons do not duplicate the physical stickers, the JTB adopted an electronic sticker that will have a “Quick Response” code that will enable seamless verification. |

||||||||||||

| Will the taxpayer get any proof of payment? | Yes.

Alongside the electronic sticker, the taxpayer will be issued a POS payment print out showing details of payment. |

||||||||||||

| When was this initiative approved by the Board? | The Joint Tax Board at its 150th meeting held in Abuja on the 23rd of June 2022, approved the SIRTS and SHF initiative wherein all members agreed to sign the Memorandum of Understanding. | ||||||||||||

| Who is the State Coordinator for the Project? | The State Coordinator is any person appointed by the Executive Chairman of the State Internal Revenue Service to monitor the progress of the SIRTS & SHF initiative and provide periodic reports.

The State Coordinator shall be a staff of the State Internal Revenue Service. |

||||||||||||

| Will the Vendors and State Coordinators be trained? | Yes.

The Vendors and the State Coordinators will be trained to enable them to understand the initiative. |

||||||||||||

| How will motorists be made to comply to the SIRTS and SHF? | The implementation of the initiative will be driven by an e-enforcement platform wherein the e-enforcement agents in collaboration with the officers of the Federal Road Safety Commission will be attached to the various entry and exit points of the States.

The e-enforcement agents will have a device that can capture the number of the vehicle from a 100-meter radius. The system automatically checks for the level of compliance of the vehicle without stopping the vehicle. Upon completion of the system check, a broadcast message is sent to other entry/exit points. Only non-compliant vehicle will be apprehended at the next entry/exit point. |